3 headwinds facing revenue cycle leaders in 2025

This quarterly Revenue Cycle Intelligence Benchmarking report reveals three headwinds buffeting revenue cycle leaders and how to turn them into tailwinds.

Feb 27, 2025

The federal government nor any political party controls the weather through a secret weather machine despite what conspiracy theorists say. Similarly, payors want revenue cycle leaders to believe payors control the fate of claims providers submit for payment. That’s also false. Despite the revenue cycle headwinds that providers will face this year, it’s the skilled revenue cycle leaders who can tack through the headwinds and control and improve their organizations’ revenue cycle performance.

Introduction

All successful journeys begin by asking and answering three questions:

- Where are we?

- Where are we going?

- How do we get there?

Healthcare revenue cycle leaders at the nation’s hospitals and health systems are asking themselves the same three questions as they head into 2025 with a new administration, a new HHS secretary, and a new CMS administrator.

In addition to those reimbursement policy unknowns, healthcare revenue cycle leaders are facing three headwinds being whipped up by payors’ claims-paying behaviors. Kodiak sees those headwinds building strength in our data. And they’re on a direct path for providers’ revenue cycle performance this year.

Rather than letting the three headwinds blow them off course, hospitals and health systems can deploy several strategies and tactics to navigate through or around the headwinds and actually improve their revenue cycle performance in 2025.

To that end, this quarterly key performance indicator revenue cycle benchmarking report from Kodiak tells revenue cycle leaders where they are, where they’re going, and how they can get there successfully.

The objective claims data analyzed for this quarterly KPI benchmarking report comes from the Kodiak Revenue Cycle Analytics platform used by 2,000 hospitals and 275,000 physicians to manage their net revenue and monitor their revenue cycle performance. Kodiak weights the average and uses raw benchmarking data to make the KPI calculations.

Download our latest quarterly KPI benchmarking reports

- November 2024: Some payors hit snooze button on Two-Midnight Clock

- August 2024: Death by a thousand requests

- May 2024: Necessity is the mother of claim denials

Read here.

Where we are

As mentioned in the introduction to this report, Kodiak’s revenue cycle KPIs and the claim data Kodiak uses to build those KPIs are based on actual claims data from 2,000 hospitals and 275,000 physicians who use Kodiak RCA. The hospitals and physicians collectively represent $262 billion in open accounts receivable and nearly $1.6 trillion in annual gross revenue.

To know where revenue cycle performance stands nationally at any given moment, Kodiak maintains a National Payor Scorecard. The National Payor Scorecard highlights select revenue cycle KPIs from the full set of 56 revenue cycle KPIs that Kodiak tracks based on that objective claims data.

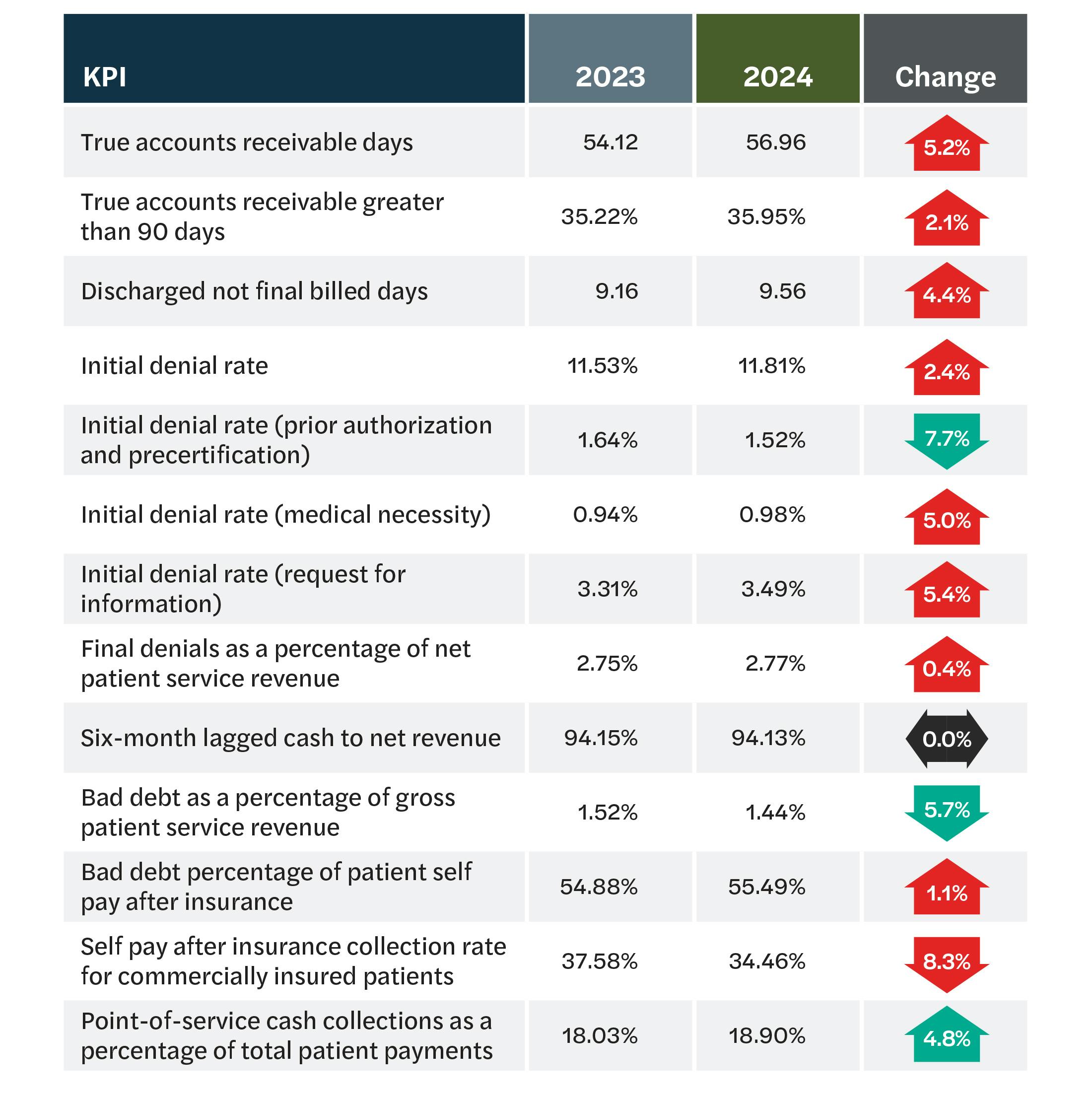

When comparing organizations’ revenue cycle performance in 2024 with 2023 using the select 13 KPIs, the organizations posted mixed results.

As the chart below shows, providers slipped on things like initial denial rates and accounts receivable but gained on things like bad debt and point-of-service collections.

Headwind #1: Growing initial and final denials

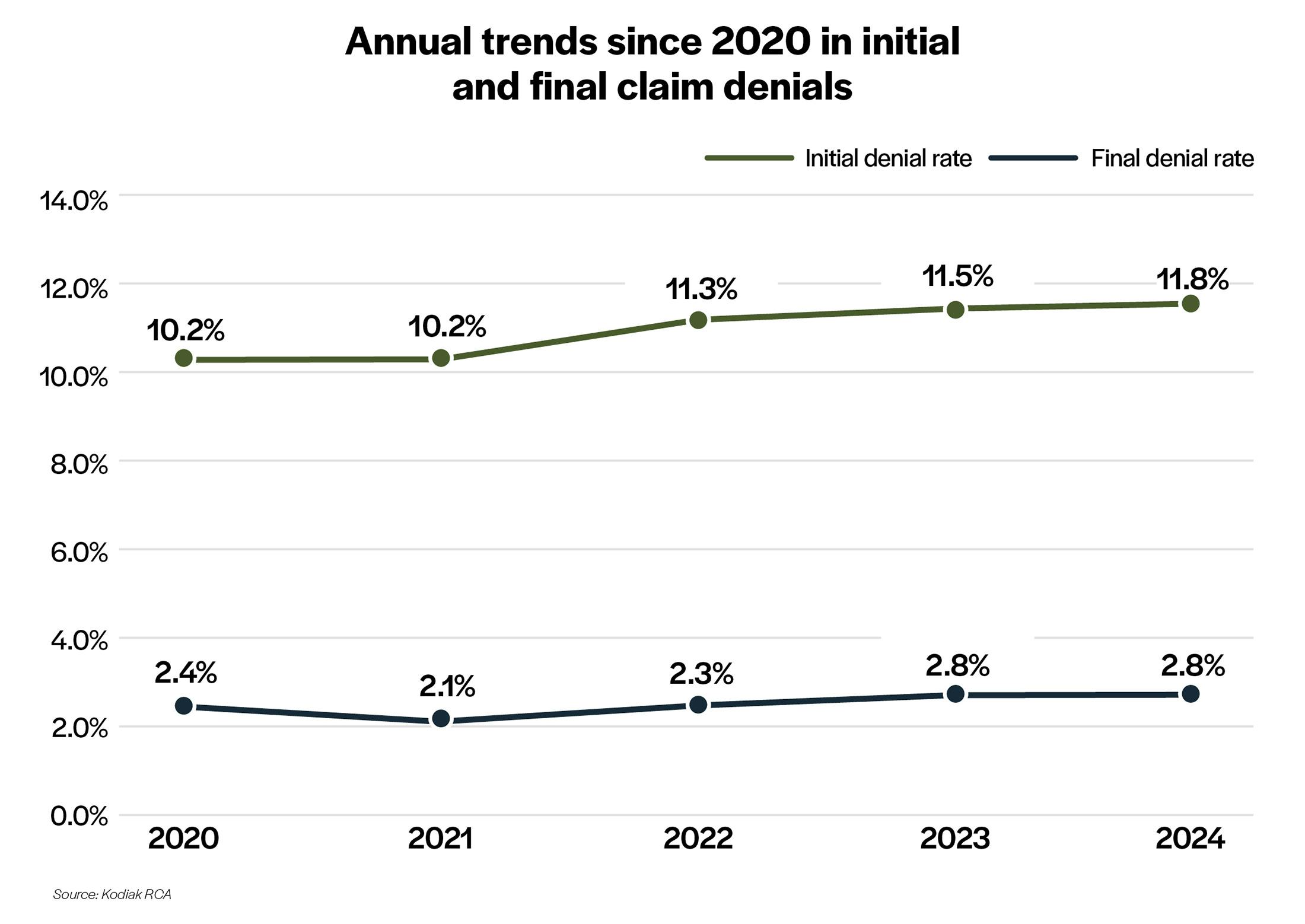

The data suggests that those two denial rates will continue their steady upward climb, absent any actions by healthcare organizations to reverse them.

Headwind #2: Growth in Medicare managed care

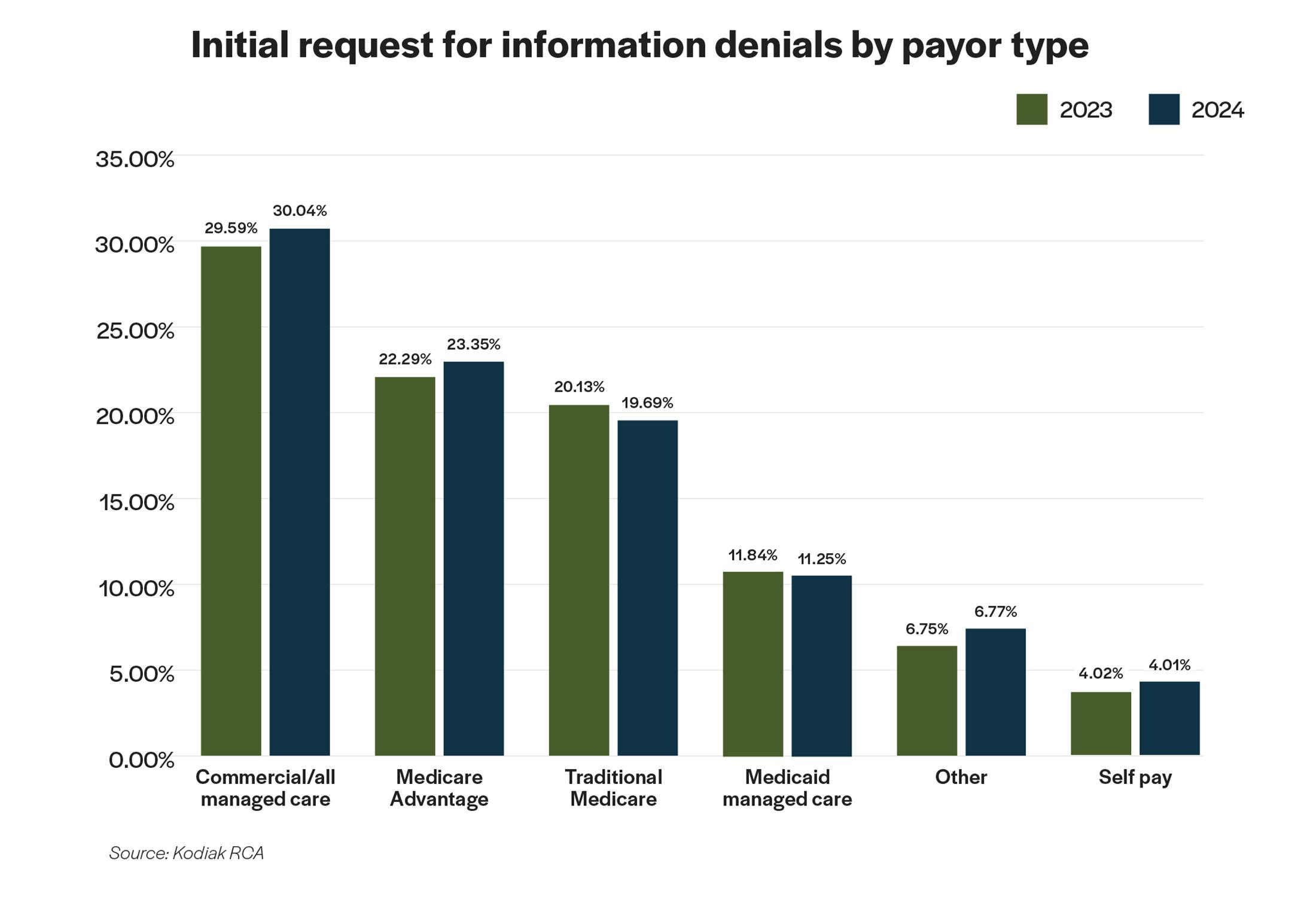

Not only did initial RFI denial rates increase in those two payor categories, those two payor types had the highest overall initial RFI denial rates both in 2023 and 2024.

Digging to the next level above the initial denial rates in the National Payor Scorecard, Kodiak’s analysis for this report uncovered a revealing pattern in initial request for information denial rates by payor type. From 2023 to 2024, initial RFI denial rates in most payor categories were relatively unchanged or actually lower. The notable exceptions were for patients insured by commercial health plans and patients insured by Medicare Advantage plans run by commercial insurers. Those initial RFI rates were up 1.5% and 4.8%, respectively, last year.

Headwind #3: Growth in patient responsibility and collection challenges

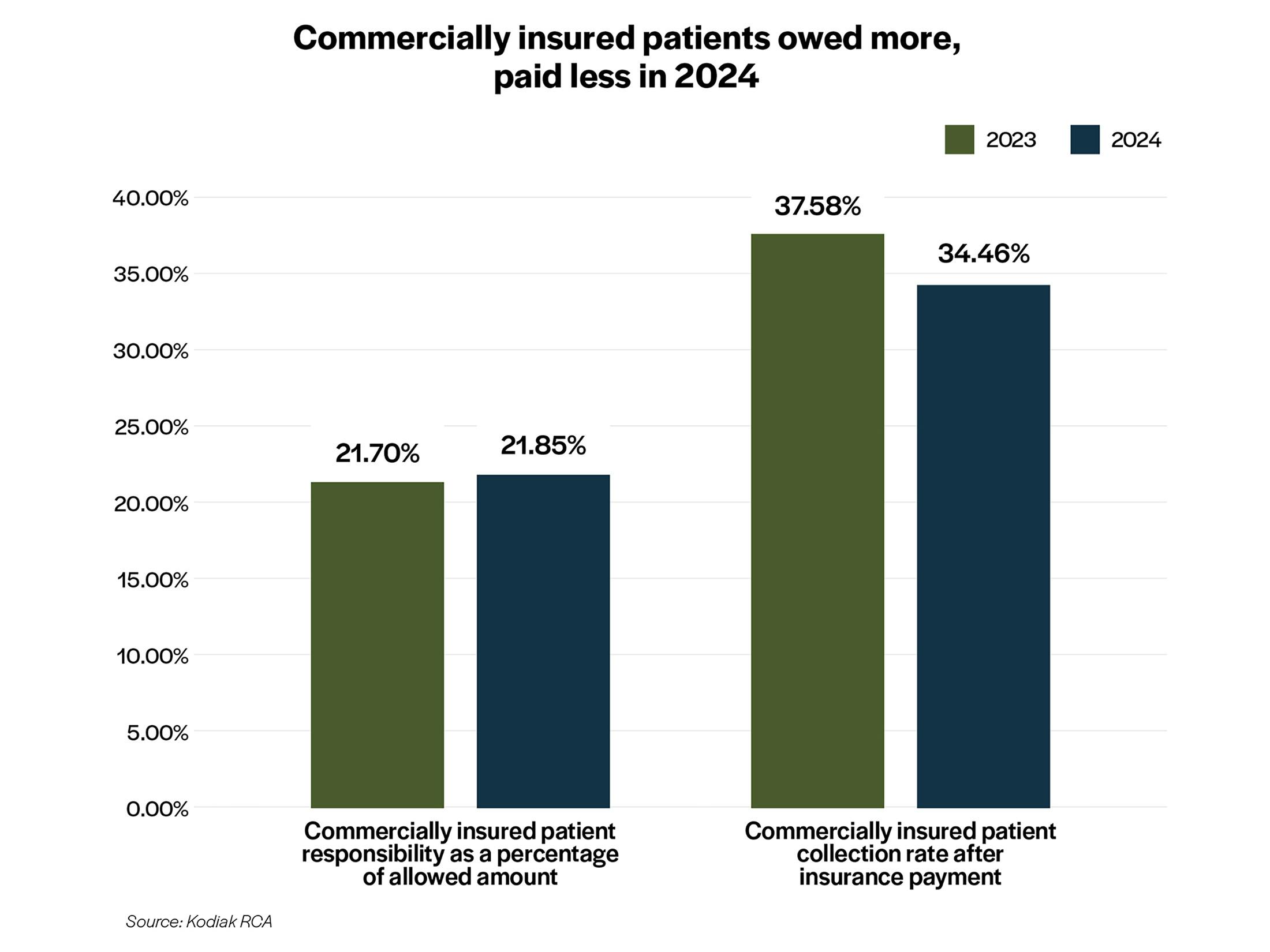

The overall good news in bad debt and POS collections as displayed in the National Payor Scorecard is offset by bad news in patient responsibility and ability to collect what patients owe after their insurers pay their share of allowable amounts. The analysis for this report identified two disturbing trends. First, commercially insured patients were responsible for a greater share of their own medical bills in 2024 compared with 2023. Second, commercially insured patients are paying less of what they owe after insurance.

The fact that commercially insured patients owed more and paid less last year, according to the analysis, had a compounding negative impact on revenue cycle performance.

Exacerbating the situation are new federal rules that remove unpaid medical bills from consumer credit reports. That removes an incentive for patients to pay their share of their medical bills after their health plans pay their share. The rules are scheduled to take effect on March 17, 2025. But the fate of the rules is unclear after the shake-up at the Consumer Financial Protection Bureau under the new administration.

Turning headwinds into tailwinds

When Kodiak looked behind the numbers in the National Payor Scorecard, the analysis identified three headwinds that threaten to slow or reverse healthcare organizations’ revenue cycle performance in 2025:

- Initial and final denial rates are slowly but steadily increasing.

- Initial RFI denials by commercial health plans and Medicare Advantage plans are not only higher than other payor types but increasing.

- Commercially insured patients are responsible for an increasing share of their medical bills and are paying less of what they owe to providers.

One is enough to blow hospitals and health systems off course. All three could swamp the boat.

But there are numerous effective strategies and tactics leading hospitals and health systems are taking to navigate through or around these headwinds and more, according to Kodiak’s conversations with revenue cycle executives at the 2025 Revenue Circle invitation-only event Jan. 26-28 in Scottsdale, Arizona.

For instance, to deal with rising initial and final denial rates, revenue cycle leaders are:

- Integrating their clinical departments into their revenue cycle operations.

- Escalating legal options against suspect payor behaviors.

- Automating low- or no-value patient accounts.

- Using better and advanced analytics to identify and mitigate root causes of denials.

- Deploying generative AI for claim denial appeal letters.

- Enhancing front-end revenue cycle processes.

- Setting up distinct and resourced task forces to deal specifically with claim denials.

- Focusing on DRG downgrades that deny claims or reduce claim payments.

To deal with initial RFI denials by commercial health plans and Medicare Advantage plans, revenue cycle leaders are:

- Developing stronger, more granular, and more precise payor scorecards to document inflated initial RFI denial rates.

- Creating data communities to share information on initial RFI denials by payor categories.

- Inserting stronger language in payor contracts and service-level agreements to limit pre-payment audits and denials.

- Escalating legal options against suspect payor behaviors.

- Terminating contracts with specific payors all together.

To deal with growing the financial responsibilities of commercially insured patients who are less likely to pay their bills, revenue cycle leaders are:

- Improving patient education efforts on patients’ health plan benefits designs.

- Enhancing communication with patients through their entire financial experience.

- Renewing their focus on POS collections.

- Working with advocacy groups to call attention to health plan benefits designs that fail to adequately cover patients’ medical needs, often leading to patients being underinsured.

- Monitoring bad debt within their overall net revenue leakage tracking.

Clearly, there are many things revenue cycle leaders can do to turn these headwinds into tailwinds. What strategies and tactics are right for your healthcare organization?

Contact the dedicated and experienced revenue cycle specialists at Kodiak, and let’s explore your options.

Together, we can make it through 2025 and come out safe and financially secure on the other side.