Code breakers

Nearly 60 new or revised billing codes put more than 12% of hospitals’ net revenue in play. Will you crack the code or crash and burn?

Nov 10, 2025

What happens at the beginning is important. What happens at the end is important. It’s what happens in the middle, however, that largely determines whether a payor reimburses a provider accurately, fairly, and on time for care and services provided to a patient. Welcome to the middle section of the revenue cycle.

A key function in the middle section of the revenue cycle continuum is coding. It’s the codes that coders, whether they be people or artificial intelligence, assign to the particular aspects of a patient’s episode of care. The codes determine how much a provider can bill for that episode of care and how much a payor will reimburse a provider for that episode of care.

Every provider uses the same set of codes. One set of about 55,000 codes for inpatient care. Another set of more than 11,000 codes for outpatient care. Adding, deleting, updating, or revising codes can have a big impact on net revenue, as doing so affects what providers can bill for, how much providers can bill for, and how much payors will reimburse them.

This quarterly revenue cycle benchmarking report from Kodiak looks at the potential impact of coding changes that take effect on Jan. 1, 2026, for invasive cardiology and interventional radiology, two types of common, high-volume services performed on an outpatient basis by interventional cardiologists, interventional radiologists, and vascular surgeons in hospital-based care settings, ambulatory surgery centers, and office-based labs.

As this report demonstrates, the stakes are high for mastering the coding changes quickly, as the changes put more than 12% of hospitals’ net revenue in play.

Download our latest quarterly Revenue Cycle Benchmarking Intelligence reports

- August 2025: How four different Medicaid disenrollment scenarios would impact hospitals’ net revenue and income

- May 2025: Closing the revenue cycle performance gap

- February 2025: 3 headwinds facing revenue cycle leaders in 2025

Read them all here.

Introduction

The Centers for Medicare & Medicaid Services published its proposed Hospital Outpatient Prospective Payment System and Ambulatory Surgery Center rule for calendar year 2026 on July 15, 2025. A day later, on July 16, 2025, CMS published its proposed Medicare physician fee schedule rule for calendar year 2026. CMS finalized the 2026 Medicare physician fee schedule rule on Oct. 31, 2025. The hospital OPPS final rule has not yet been published but is expected before the end of the year. That would be appropriate, as the OPPS and physician fee schedules and coding changes take effect on Jan. 1, 2026.

Hospitals, health systems, and medical practices have a small window to absorb changes in the OPPS and physician fee schedules that will affect them clinically, financially, and operationally.

Among the changes that could have a dramatic effect on provider organizations are those to billing codes for invasive cardiology and interventional radiology, two of the most common outpatient services offered by hospitals, health systems, and medical practices.

Examples of IC services performed by interventional cardiologists:

- Angioplasty

- Arrythmia ablation

- Stenting

- Transcatheter aortic valve replacement

Examples of IR services performed by interventional radiologists:

- Biopsies

- Catheter placements

- Embolization

- Peripheral (leg) interventions

According to Interventional CardioHub, there are nearly 160 different CPT codes for IC procedures. The Society of Interventional Radiology says there are nearly 300 different CPT codes for IR procedures. CMS’ proposed OPPS and final Medicare physician fee schedules would affect at a minimum 18 existing CPT codes for IC, according to an analysis of the fee schedule by Kodiak’s revenue cycle coding specialists.

- 10 existing CPT codes will have updated descriptions/definitions

- Eight existing CPT codes will be eliminated

- Two new CPT codes will be created

Meanwhile, CMS’ proposed OPPS and final Medicare physician fee schedules would affect at a minimum 16 existing CPT codes for IR, according to Kodiak’s analysis:

- 16 existing CPT codes will be eliminated

- 46 new CPT codes will be created

In all, the proposed OPPS and final Medicare physician fee schedules would make at a minimum 84 coding changes affecting two services that hospitals, health systems, and medical practices perform thousands of times each day across the country.

Net revenue

The first question revenue cycle leaders should ask is why the coding changes for IC and IR matter other than them being a more precise way to capture how clinicians perform those services today. The why is net revenue.

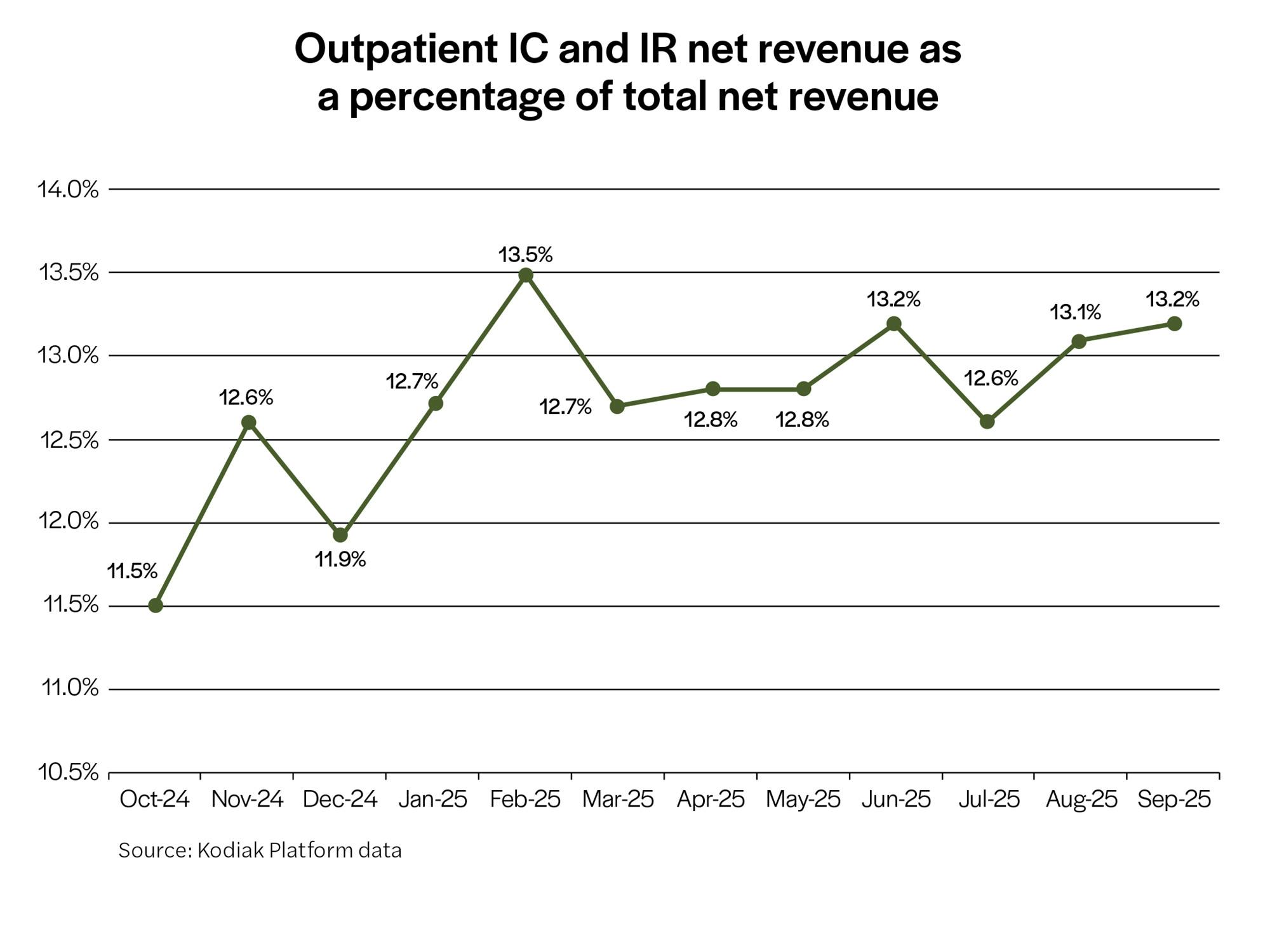

The analysis Kodiak’s revenue cycle team conducted for this quarterly KPI benchmarking report reveals that the net revenue outpatient IC and IR services generate for hospitals, health systems, and medical practices represented an average of 12.7% each month of providers’ total net revenue from October 2024 through September 2025.

The analysis is based on actual data from the 2,300 hospitals and 350,000 physicians that use the Kodiak Platform to manage their net revenue and monitor their revenue cycle performance.

In other words, the IC and IR coding changes that hit Jan. 1, 2026, affect nearly 13% of a typical hospital’s net revenue every month. Failing to master those changes by the start of the year would have a material and immediate negative impact on accounts receivable and cash flow at a time when most hospitals can least afford it.

Initial denials

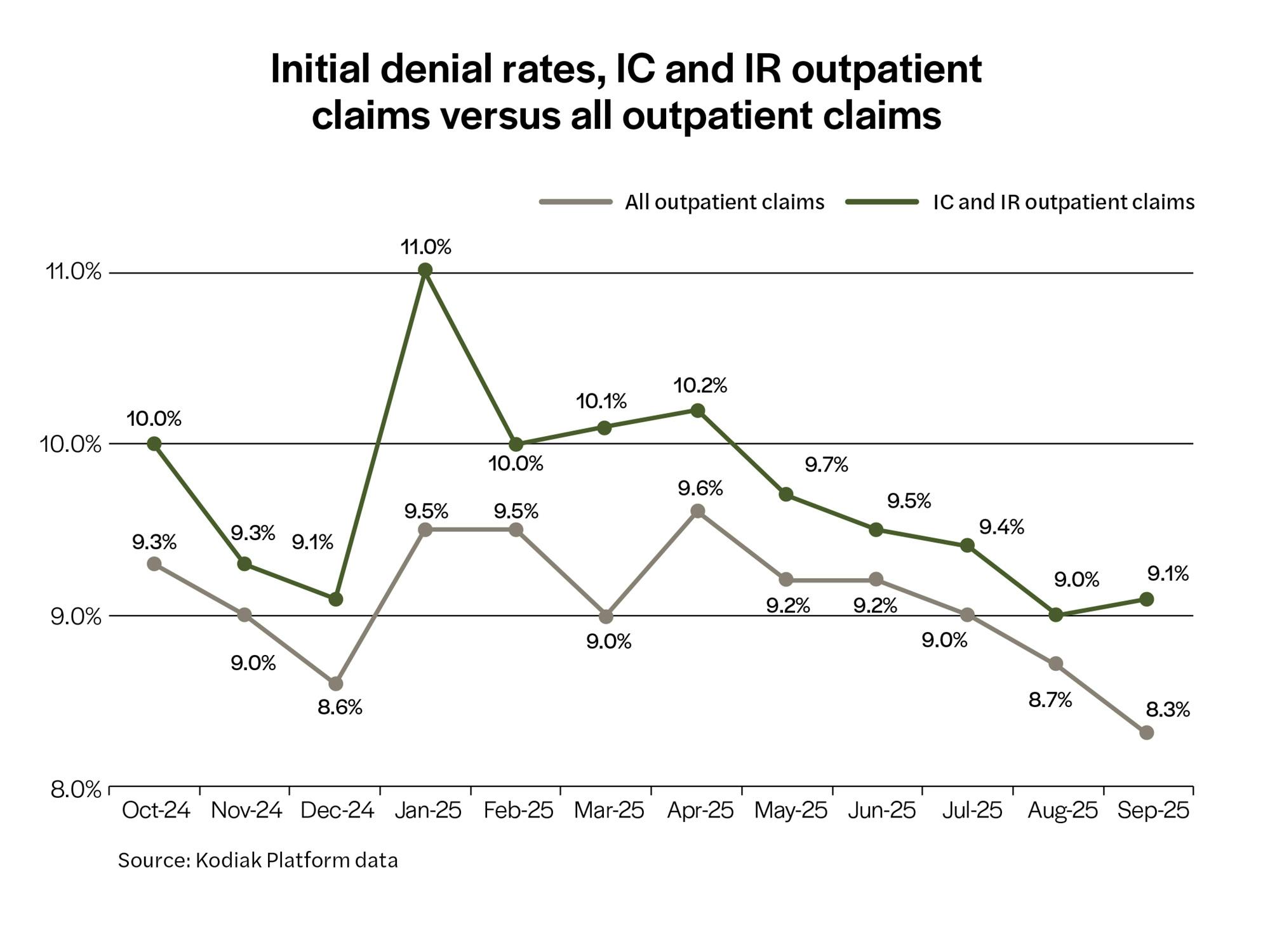

All types of hospitals, health systems, and medical practices are experiencing increasing claim denials by payors for all types of inpatient and outpatient services. That trend is especially problematic for IC and IR outpatient claims filed by providers.

The analysis Kodiak’s revenue cycle team conducted for this quarterly KPI benchmarking report found that the initial claim denial rate, expressed as a percentage of gross patient service revenue, for IC and IR outpatient claims is consistently higher than for all outpatient claims.

This suggests that payors are particularly picky about IC and IR outpatient claims. This may be because of the high volume and high value of the claims. It could be because of how providers file the claims, code the claims, and/or support the claims and codes with clinical documentation.

Regardless, any minor coding miscue of IC and IR outpatient claims starting Jan. 1, 2026, because of the coding changes could make an already challenging initial claim denial environment worse.

Initial denial causes

The finding that the initial denial rate for IC and IR outpatient claims is higher than for outpatient claims overall begs the question: why? Kodiak’s revenue cycle team dug into the Kodiak Platform data to find the reasons behind initial claim denials for IC and IR outpatient services.

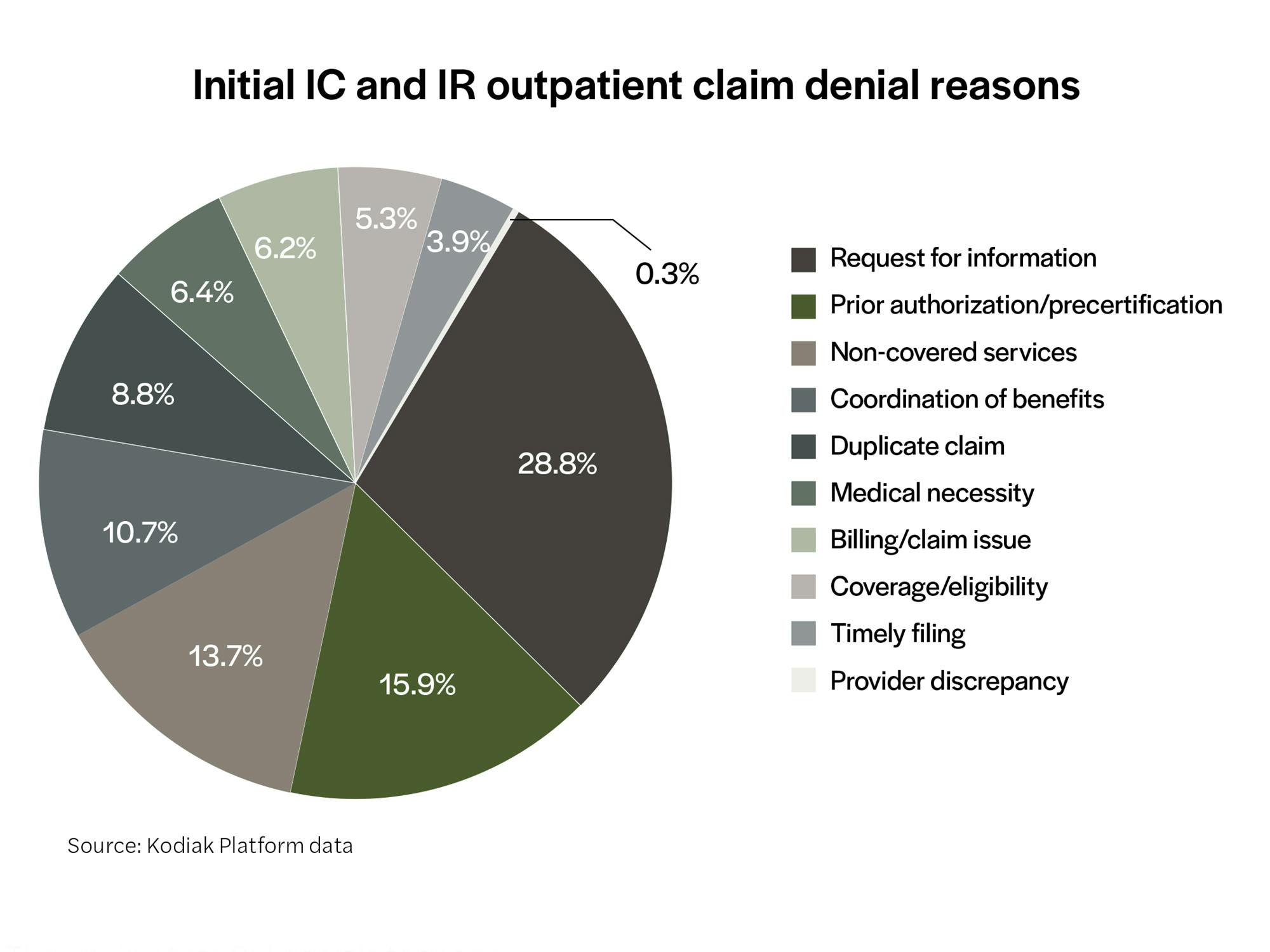

The analysis found that nearly 60% of the initial claim denials for outpatient IC and IR services were for three reasons: request for information, prior authorization/precertification, and non-covered services.

Above is the breakdown of the reasons payors initially denied IC and IR claims for the period October 2024 through September 2025.

The finding that RFI denials topped the list of reasons behind the initial denials for outpatient IC and IR claims points directly at clinical documentation. Payors are determining that the clinical documentation is either missing or insufficient to support the coding and subsequent bills for service. New and revised billing codes could only exacerbate the situation lest providers master the new IC and IR codes and the clinical documentation necessary to support them.

Final denials

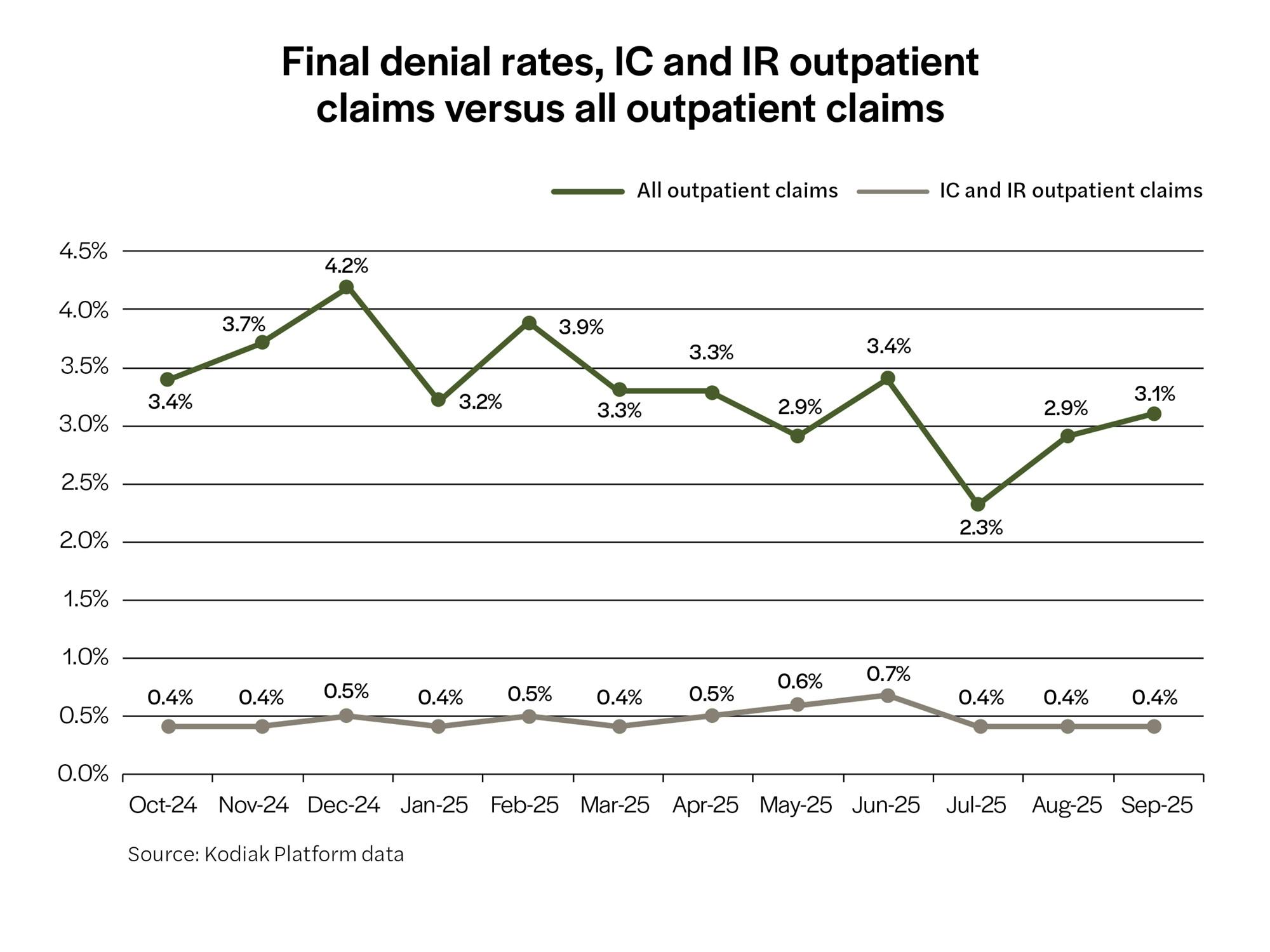

Whatever challenges providers face when payors initially deny claims for IC and IR services, providers are more than up for them, according to the Kodiak revenue cycle team’s analysis.

The average final denial rate, expressed as the percentage of net patient service revenue, for all IC and IR outpatient claims was just 0.5% from October 2024 through September 2025. That compares favorably with a 3.3% final denial rate for all outpatient claims.

The fact that the IC and IR outpatient final claim denial rate was significantly and consistently lower than the final denial rate for all outpatient services during the 12-month study period speaks to the ability of providers to successfully appeal and overturn initial claim denials for IC and IR services. The question will be whether providers can repeat their performance starting Jan. 1, 2026, when the new IC and IR coding changes take effect.

Summary

IC and IR outpatient services performed by interventional cardiologists, interventional radiologists, and vascular surgeons in hospital-based care settings, ASCs, and OBLs may be common, with providers performing them thousands of times a day across the country and generating nearly 13% of providers’ total net revenue. But how claims for IC and IR services behave is anything but common. This analysis found:

- The initial denial rate for IC and IR claims is higher than for all outpatient claims.

- The leading causes of initial denials point to clinical documentation as the culprit.

- The final denial rate for IC and IR claims is lower than for all outpatient claims.

How the significant coding changes for IC and IR services will affect that pattern is unclear. It’s possible that, at least in the short term, the changes will increase initial denial rates, exacerbate existing issues with clinical documentation, and increase final denial rates until providers master the coding changes.

Action steps

Providers can act now to mitigate the potential impact on their net revenue from the changes. Kodiak’s revenue cycle team recommends the following action steps to prepare for the new codes:

- Revenue cycle and finance teams will need to update their code sets for the changes.

- Health IT and IS teams will need to update systems and technologies, including EHR, billing, patient accounting, claims management, etc., for the new codes.

- Health IT and IS teams will need to map the new codes to the appropriate services and clinical documentation for those codes.

- Revenue cycle and finance teams will need to train coders on how to use the new codes.

- Revenue cycle and finance teams will need to educate clinicians, including physicians, nurses, and technologists, on clinical concepts and billable services reflected by the new codes.

- Revenue cycle and finance teams will need to consider how to price the clinical concepts and billable services reflected by the new codes.

- Revenue cycle and finance teams will need to educate clinicians, including physicians, nurses, and technologists on the clinical documentation required to support the new codes.

- Revenue cycle and finance teams will need to update payors’ PA and precertification protocols requirements for the new codes.

- Revenue cycle and finance teams will need to anticipate and adjust their processes for payors that may not be ready for the new codes.

- Revenue cycle and finance teams will need to anticipate and adjust their processes for payors that may use the new codes as leverage to deny claims for IC and IR services.

Finally, revenue cycle and finance teams should monitor the following revenue cycle key performance indicators to track the impact of the IC and IR coding changes to see if their action steps are successful:

- Gross revenue from IC and IR services

- Initial denial rates for IC and IR services

- RFI and PA/precert initial denial rates for IC and IR services

- Coding accuracy via retrospective analysis

- Final denial rates for IC and IR services

Medical advances in IC and IR services are inevitable as are the coding changes needed to reflect those advances. A disruption in cash flow and a reduction in net revenue isn’t—with the right preparation. The revenue cycle specialists at Kodiak can help your revenue cycle and finance teams prepare for the coding changes for IC and IR services now and into the future.